Dislocation and opportunity in global manganese markets

Disclaimer: The information contained within this website and article is not financial advice and reflects the opinion of its author in a strictly personal capacity. The author may hold positions in stocks mentioned.

The manganese market has caught our attention with the recent disruption production the world-class GEMCO mining operations located in northern Australia, owned by South 32 and Anglo-American. This operation was recently hit by Tropical Cyclone Megan with significant damage to port, shipping and logistical infrastructure, as well as damage to the mine itself.

GEMCO is a globally significant production asset, providing (according to the US Geological Survey) around 12% of the global manganese ore market production or 15% of ‘contained’ manganese production. There is significant uncertainty around the duration of the supply disruption given the sheer scale of damage incurred and remote location. Importantly, GEMCO supplies approximately half of the high specification manganese (44% Mn) market.

In our experience, supply side disruptions in commodities tend to have excellent risk/reward characteristics given the time and challenges required to bring new production into the markets. One historical example, is the flooding of the Cigar Lake uranium mine in 2006 which caused uranium spot markets to spike >100% over the consequent 9 months given the material proportion of global supply (>5%) it had been contracted to produce.

Long term uranium offtake prices rose 50% of the next 18 months and remained elevated over the next 5 years. The effect on uranium stocks during this period was spectacular to say the least however, the most sustainable benefits were captured by the existing producers with asset quality always being an important factor.

Manganese is integral to the steel making process and we believe that steel production will continue to grow driven by rapid urbanisation in India and other parts of Asia over the longer-term.

We expect the manganese markets to strengthen significantly in the coming months, as the timeline becomes more certain around the time required for an operational restart at GEMCO. S32 are expected to provide an update on operations in their periodical quarterly update due on the 22nd of April.

We expect manganese producing assets in other locations to benefit from the positive market dynamic; with an onus asset quality and an existing production base.

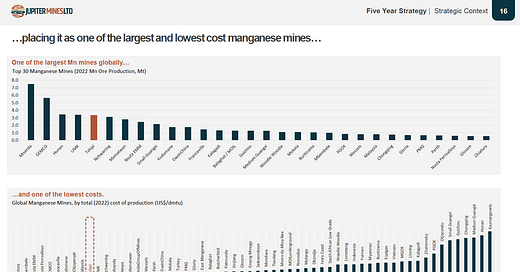

Our preferred exposure to capture this thesis is via Jupiter Mines (JMS.AX).